Real Estate Investing – Market Analysis

Steve Nomura July 20, 2019

Market Analysis 101

Where should I start doing real estate investment?

How should I choose the area for this RE investment?

My general answer is you should do this business in our back yard. It means you should do this within 30 min driving range from your home. Especially if you are new to this business, you should do this business in the area you can go easily.

I know there are people buying properties outside of their state nationwide. That is possible if you have a certain level of experience int this business and also if you have someone who you can really trust and who have the same level of ability like you, you can do business outside of your state. Otherwise it is too risky.

We can check the market national level, regional level, state level, city level and local level.

You should know the situation of national, level or state level but the important thing is real estate is local.

You can analyze the market in the same way in a different level. Once again, the most important data is our local data.

Let us talk about the type of markets

There are several types. Buyer’s market and seller’s market. Or broad market and thin market.

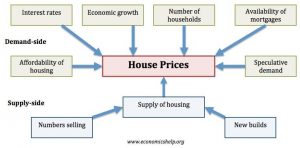

Generally the market is determined by the rule of supply and demand.

Buyer’s market means there is excess of supply. There are more houses than buyers. Buyers have lots of choices. They don’t need to rush to buy. They don’t need to do highest price offer. On the other hand, the seller has to make a nicer house with a lower price. Buyers can move slow and they can think a bit and buyer can negotiate about the price The buyers have a strong negotiation power on price.

Seller’s market means there are more buyers than houses on the market. There are not so many inventories. Many offers on one property with more than listing price. Buyers should make a decision quickly. Buyer have to come up with the highest offer. Accordingly the price will increase

Broad market means the market has a lot of buyers and sellers. It is pretty even between those two side of people. Buying and selling is not fast nor slow.

Thin market means very slow market because there are very few buyers and very few sellers.

A look at factors affecting the demand and supply of housing. In summary, some of the main factors include:

How the property value goes up?

Economical factors, social factors and political factors

key factor that affects the value of real estate is the overall health of the economy. This is generally measured by economic indicators such as the GDP, employment data, manufacturing activity, the prices of goods, etc.

If you look at the area more locally, you have to pay attention such as

Big companies are coming like Walmart, Target, Home Depot, Menards, Jewel-Osco etc

Mall are created

Big Hospital will be built.

They provide huge job opportunities.

Social Factors

Which way the population is shifting.

There are good schools

Very nice parks

Political factors

We can consider pollical factors in federal level, state level or local level.

For example, in 2009, the U.S. government introduced a first-time homebuyer’s tax credit to homeowners in an attempt to jump-start home sales.

The area of train station was developed. Where the local government decide to build a big library, stadium etc. Those give lots of impact to the local market.

When you decide your farm area? Again it should be in your back yard especially in the beginning.

Then after you have more experiences, you can expand your area to match your particular strategies.

At the same time you have to learn overview of the real estate investment strategies.

Then you can capitalize any deals.

Sometimes you have to adjust your strategies based on the area you are working.

If you can deal with any kind of exit strategies, you don’t mind what kind of area that is. You might find a very distressed properties that needs rehabbing. You might find a well maintained properties that needs very cosmetic work.